Financial Downturn provides opportunities—if you protect your downside.

Despite occasional downturns over the last 40 years, the stock market has created far more wealth than all other investment categories, including real estate, commodities, bank accounts or insurance products. But with the recent incredible loss of wealth, there are cautionary tales to be told.

While in a bull market most investors are happy with growing account values and profits. However, unforeseen events can create sudden, catastrophic investment situations. These times call for a different approach: a way to grow your money while employing protective methods against downside risks. These times are made for Vaughan Investment Advisors (VIA).

About VIA

Vaughan Investment Advisors, LLC is known for their smart, innovative investment programs. We provide a unique, hands-on approach to managing customer accounts, regardless of size of account or a client’s net worth. Marty Vaughan, founder of VIA, brings 35 years of experience in the financial services industry, including an extensive background in insurance and investment management. Every VIA customer has access to Vaughan’s ingenious hedging strategies.

The US stock market has created great wealth in the last century. There are countless stories of fortunes made, even with passive buy and hold strategies. VIA believes in the US stock market and does not use “market timing” to try to predict the ups and downs to trade into and out of the market. VIA accounts are invested primarily in Large Cap US stocks and Large Cap Stock Exchange-Traded Fund (ETFs), as well as Call and Put Options of the same stocks.

More than 120 years of history has proven time and again the resilience of the US stock market. Unfortunately, many investors fear the stock market and either don’t invest in stocks at all or exit the market at the bottom. One of VIA’s primary objectives is to keep clients invested in the market, reducing their anxiety by using strategically placed Options to provide a hedge against market declines.

Our Strategies

VIA currently offers two investment strategies, based on a client’s risk tolerance:

- 80/20 Long-Short Strategy* — Our primary strategy

- 90/10 Long-Short Strategy* — For more aggressive investors

*The word short used in VIA’s description denotes a bearish position which involves investing in SPY Puts, not selling stocks short.

80/20 Strategy

VIA client’s accounts can count on varying degrees of protection against US stock market declines. VIA’s primary 80/20 Long Short strategy offers clients the most built-in protection. Based on real life examples during declining markets, accounts remain near their current value and, in some cases, even increase in total account value.

As an example, two common terms for market declines are stock market corrections, which are stock declines of 10% up to 20%, and bear markets, which are declines of over 20%. A recent correction from Oct. 2018 through Dec 24, 2018 saw a 19% decline in the S&P 500. This correction was nearly a “bear market”. Despite the decline, VIA’s 80/20 accounts experienced incredible outcomes with account results ranging from 3% down to 2% up during this unexpected 19% downturn.

90/10 Strategy

Some of VIA’s clients use the more aggressive 90/10 Long Short approach. These accounts may increase more during bull markets but do not have the level of protection as 80/20 clients. These accounts have some protection which tend to materially mute or temper any losses as compared to holding US stocks alone with no protection.

Learn More

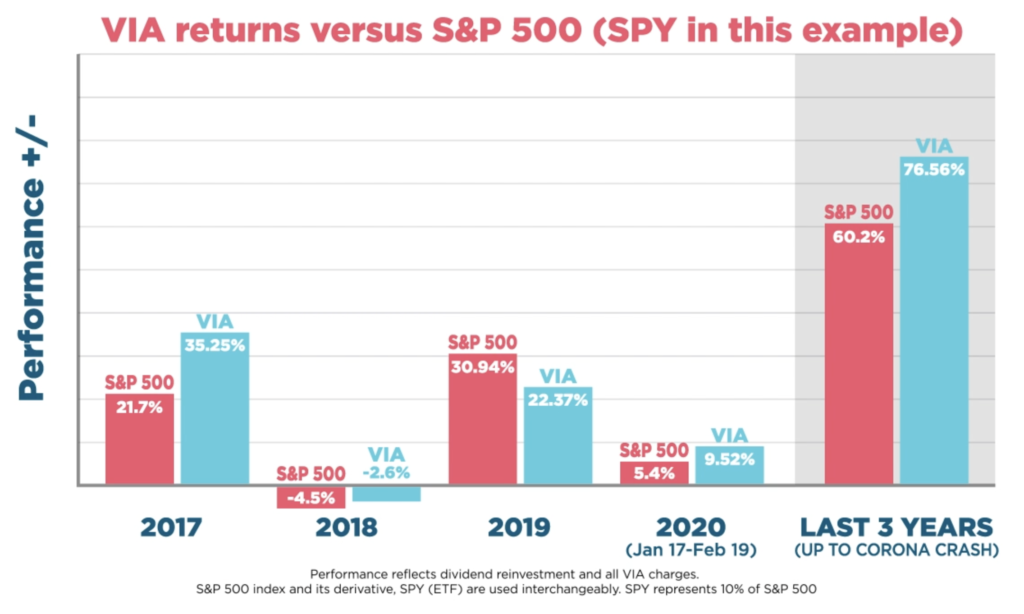

Since 2017 when the VIA strategy was fully implemented, the results are eye opening. Over the 3+ years prior to the Corona crash, VIA’s returns beat the SP&P’s 500—even with built in protection.

The VIA and S& 500 performance of 76.56% and 60.2% are excellent 3-year returns. The difference you can’t see between these approaches is that VIA had already pre-purchased protection well before the Corona crash. The VIA strategy contemplates the possibility of unknown factors such as natural disasters, wars, pandemics and alike by always having substantial S&P 500 put protection in place. A traditional buy and hold approach doesn’t have such planned protection.

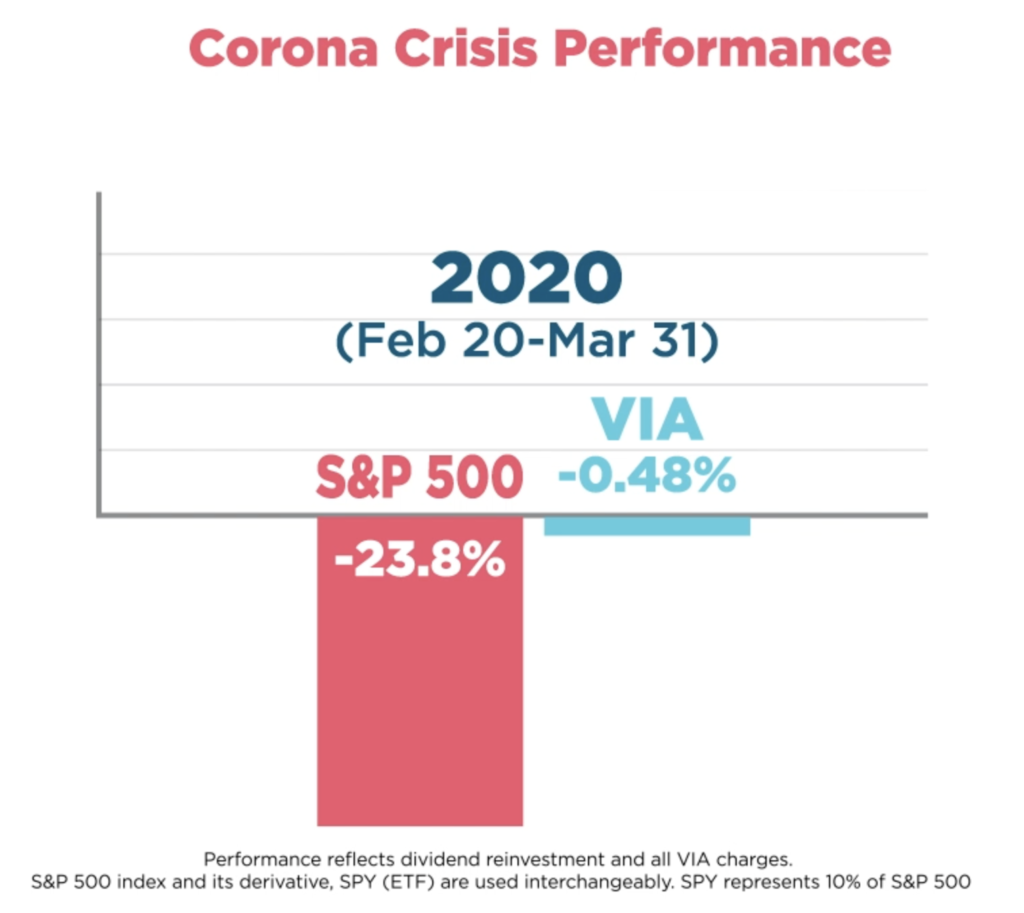

And that is why the results diverge dramatically in a downturn. From the first day of the crash (February 20) through the end of March, VIA’s account values held steady while the S&P’s dropped at an historic rate of almost 24%.

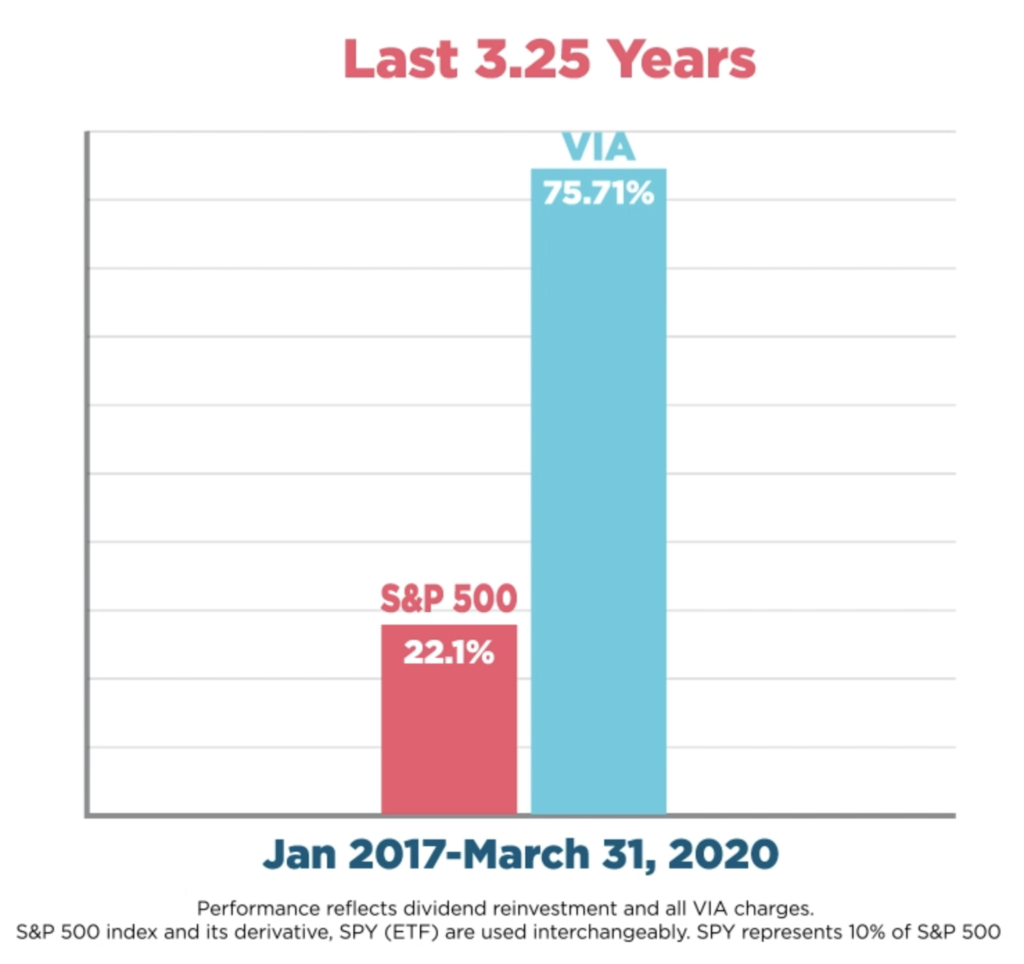

This type of protection is of significant value but normally it would come at quite a cost during a bull market. However, VIA outperformed the S&P’s before, during and throughout the entire 3.25-year period in a big way—76% to 22%.

Over this time, the VIA approach was put through its paces. There were peaks and valleys over the period concluding with an historic crash in record time. While there are no guarantees of similar returns, it exemplifies the larger point–you can make money in the US stock market while protecting yourself from crashing your account. Why not reach out to us today via phone or email? We would love to discuss your particular situation and how VIA might work for you to help achieve your financial goals.

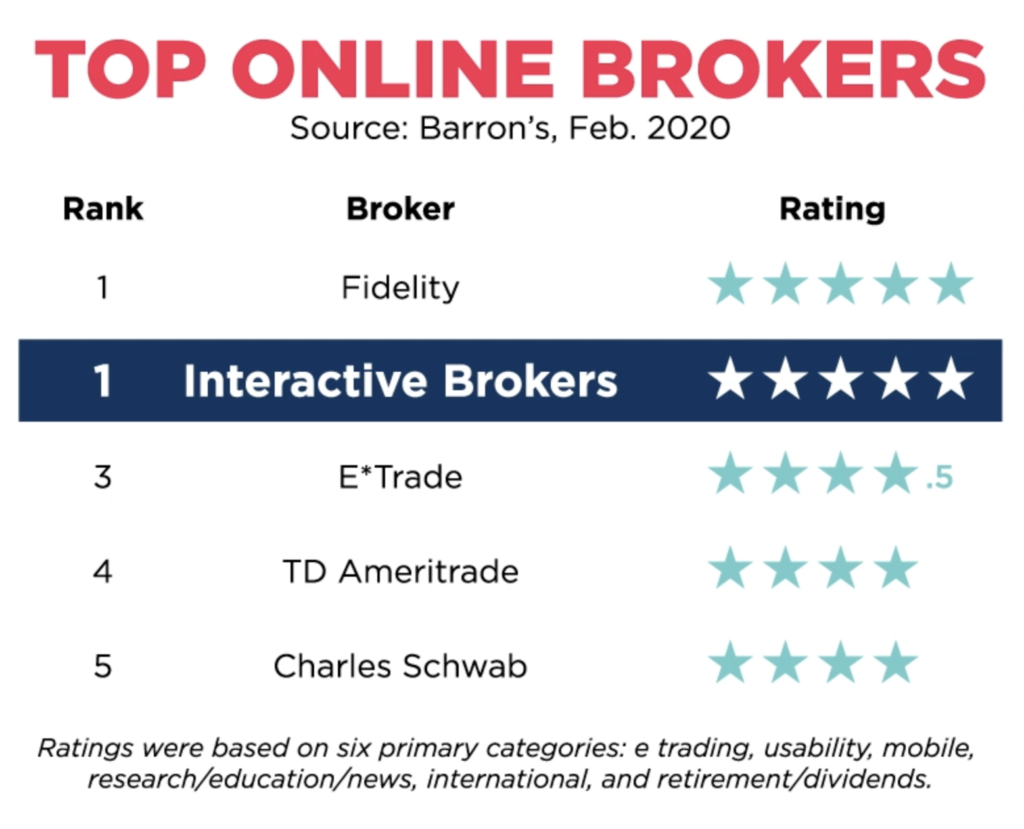

Another important aspect of VIA is its relationship with Interactive Brokers. From the beginning, VIA’s objective has been to support their clients with a state-of-the-art stock and option trading platform. If you are not familiar with Interactive Brokers, they are an award-winning firm– consistently rated as one of the best global brokerage houses.

In fact, in the 2020 Barron’s ranking of the top online brokerage firms, Interactive Brokers ranked tied for first with 5 out of 5 stars.

With Interactive Brokers size, stability and expertise, they provide us with security for our client accounts, back-office support, and real-time technology to share with our customers. VIA is proud to partner with Interactive Brokers to provide clients with the very best experience possible.

For more information about Interactive Brokers, click here to view a video from Thomas Peterffy, Founder and Chairman.

Request More Information – Contact Us

Vaughan Investment Advisors

110 E. Wilson Bridge Rd., Suite 260

Worthington, OH 43085

C 614.296.3974

P 614.450.1076

F 614.310.4732

marty.vaughan@viadvisorsllc.com